Aluminum Nitride Ceramic Substrates in Electronic Market

In 2024, the global aluminum nitride substrate (AlN) market has reached RMB530 million, showing a steady growth trend. As an advanced ceramic material with high thermal conductivity, low thermal expansion coefficient and excellent electrical insulation performance, aluminum nitride substrates are widely used in power electronics, 5G communications, LED lighting, optoelectronics and new energy fields.

Due to its high melting point, chemical stability, mechanical strength and thermal stability, aluminum nitride substrates have irreplaceable advantages in meeting the heat dissipation and electrical insulation requirements of high-performance electronic systems. In addition, aluminum nitride substrates have a variety of shapes and thicknesses, which can meet the customized requirements of different terminal application scenarios.

Key Properties of AlN vs. Other Ceramics

|

Property |

Aluminum Nitride (AlN) |

Alumina (Al₂O₃) |

Beryllia (BeO) |

Silicon Nitride (Si₃N₄) |

|

Thermal Conductivity (W/m·K) |

170–230 |

24–28 |

200–300 |

70–90 |

|

Coefficient of Thermal Expansion (ppm/°C) |

~4.6 |

~7.1 |

~6.5 |

~3.2 |

|

Electrical Insulation (kV/mm) |

≥15 |

≥10 |

≥10 |

≥12 |

|

Dielectric Constant (1 MHz) |

~8.6 |

~9.8 |

~6.6 |

~7.8 |

|

Max Working Temperature (°C) |

1000 |

600–800 |

1000 |

850 |

|

Toxicity |

Non-toxic |

Non-toxic |

Toxic |

Non-toxic |

Current Market Landscape and Application Areas

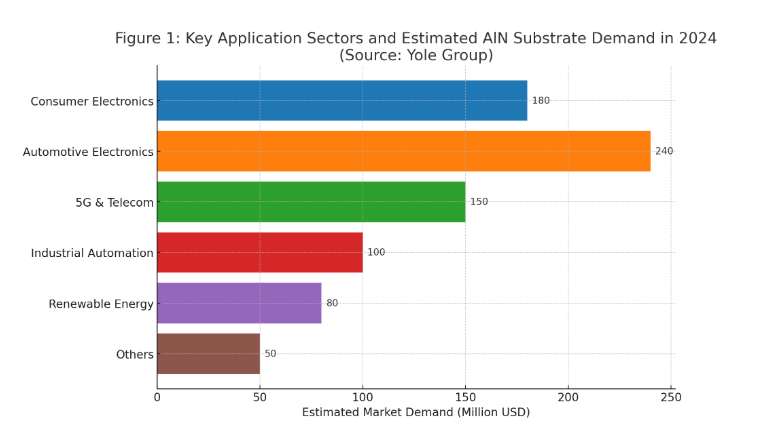

AlN substrates are finding increasing use across multiple high-growth sectors:

- Consumer Electronics: Used in LEDs, power supplies, and portable electronics where thermal management is vital.

- Automotive Electronics: Essential in electric vehicles (EVs) for power control units, inverters, and battery systems.

- 5G & Telecommunications: Incorporated in RF modules, power amplifiers, and antenna systems requiring both thermal and electrical performance.

- Industrial Automation and Renewable Energy: Employed in high-power control systems and modules in wind and solar power converters.

(Figure 1: Key application sectors and estimated AlN substrate demand in 2024)

Global Market Dynamics and Regional Insights

Asia-Pacific remains the largest market for AlN ceramic substrates, accounting for over 60% of global consumption in 2023. China alone contributed approximately USD 220 million to the AlN substrate market, driven by its aggressive push into EV and semiconductor sectors. Japan and South Korea maintain strong positions due to high R&D investments and longstanding expertise in ceramics.

In comparison, North America and Europe are witnessing steady growth, particularly in aerospace, medical electronics, and defense applications. Government-backed initiatives such as the U.S. CHIPS Act and the EU Chips Act are expected to further stimulate regional demand for high-performance substrate materials.

Technological Advancements Shaping the Industry

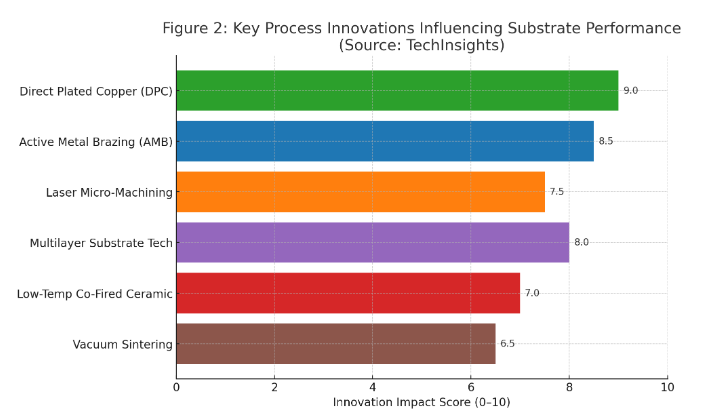

The industry is witnessing significant advancements in:

- Direct Plated Copper (DPC): Enables thinner metallization layers (as low as 20 µm) with high bonding strength.

- Active Metal Brazing (AMB): Ideal for high-power modules needing thick copper layers (>0.3 mm).

- Laser Micro-Machining: Facilitates precision vias <100 µm in diameter, improving high-density interconnects.

- Multilayer Ceramic Substrates: Co-fired AlN-based multilayers supporting complex and compact module designs.

Figure 2: Key process innovations influencing substrate performance

Competitive Landscape and Leading Suppliers

The global AlN ceramic substrate market is moderately consolidated. Key players include:

- Maruwa Co., Ltd. (Japan): Pioneering in high-purity AlN substrates with thermal conductivity >200 W/m·K.

- Denka Company Limited (Japan): Offering advanced sintering technology and superior flatness.

- Heraeus Electronics (Germany): Known for AMB substrates used in EV modules.

In China, domestic suppliers such as Fujian Huaqing and Shenzhen Xin Tong Ling are increasing production volumes and improving yields. By 2025, China is projected to supply over 35% of global AlN substrates.

Forecast and Growth Drivers: 2025 to 2030

According to Market needs, the AlN ceramic substrate market is expected to grow from USD 470 million in 2024 to USD 950 million by 2030, at a CAGR of 12.5%.

Growth is driven by:

- Continued expansion of 5G infrastructure and AI-integrated devices

- EV demand surging globally, requiring robust power modules

- Investment in renewable energy and grid infrastructure

- Push for domestic semiconductor production in major economies

Conclusion: Strategic Material for the Next Wave of Electronics

Aluminum nitride ceramic substrates are more than just a thermal solution—they are becoming a strategic enabler of high-performance electronic systems. As industries move toward higher power densities and tighter integration, the demand for advanced substrate materials like AlN will only intensify. For PCB manufacturers, material suppliers, and OEMs, aligning with this trend means investing in high-precision fabrication capabilities and strengthening supply chain resilience.

About Best Technology

Best Technology is a certified PCB manufacturer specializing in ceramic PCB solutions, including aluminum nitride substrates. We have a stable AlN ceramic substrate chain from authorized ceramic substrate supplier, such as Huaqing, Heraeus, Dupont, Denka and so on. We have enough storage in our warehouse, so that can make sure the fast lead time. With strict quality control, advanced production lines, and engineering expertise, we help customers in automotive, medical, and communication industries achieve thermal performance and reliability. Contact us for custom solutions that meet your technical and market needs.

HOME

HOME